Lighthouse, a project made by the Spanish Institute of Financial Analysts (Instituto Español de Analistas Financieros-IEAF), focused on independent corporate analysis, aiming the secondary equity market, and supported by BME (Bolsas y Mercados Españoles), has recently started its coverage of Netex, with a first analysis.

Lighthouse Report on Netex, July 2022

The perfect wave?

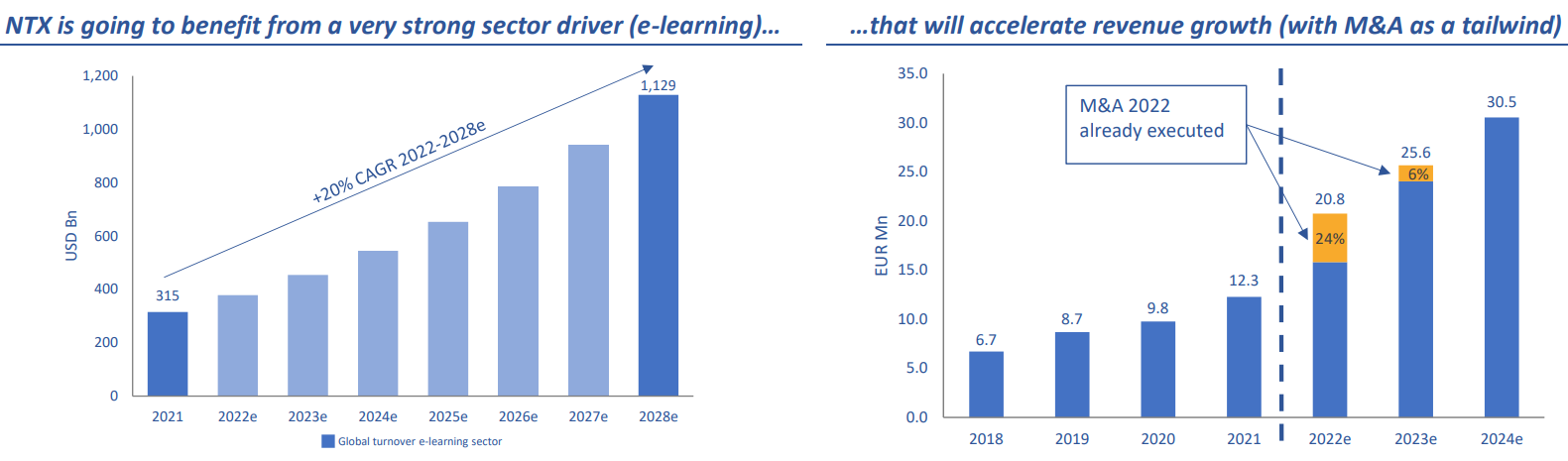

STRONG GROWTH… Over 2017-2021 the company’s high organic growth rate (24.6% CAGR) and ability to exploit economies of scale in its structural costs were key to exceeding break-even in Rec. EBITDA (EUR 1Mn in 2021).

…THAT WE EXPECT TO CONTINUE. For several reasons: (i) the impact of the integration of Virtual College (2022e proforma revenue EUR 6.6Mn; 36% growth until 2024e), (ii) the high recurrence in licences and the growth potential of projects for companies, (iii) the continued international expansion and, especially, (iv) the sector driver, by exploiting the take-off of a sector with tailwinds (e-learning). Organic revenue growth +25% (2021-2024e CAGR).

Netex has grown at very high rates (24.6% CAGR) in recent years and operates in a sector (e-learning) that continues to grow at a high double-digit rate (+20% CAGR).

According to the Lighthouse report, the company’s growth, together with the already proven operating leverage, will allow Netex to continue to grow recurring Ebitda and cash positive from 2023, with an expected P/E ratio in 2024 of 6.3x and EV/Ebitda of 5.1x.

For personalised conversations, please contact us at investors@netexlearning.com